2 Myths Holding Back Home Buyers

In a recent article, First American shared how millennials are not really any different

from previous generations when it comes to the goal of homeownership; it is still

a huge part of their American Dream. The piece, however, also reveals,

“Saving for a down payment is one of the biggest obstacles faced by

first-time home buyers. Dispelling the 20 percent down payment myth could open

the path to homeownership for many more.”

the same article:

“Americans still overestimate the qualifications needed to get a mortgage,

resulting in qualified potential buyers not even considering homeownership.

Indeed, the Urban Institute report revealed that 16 percent of consumers

believed that the minimum down payment required by lenders is 20 percent

or more, and another 40 percent didn’t know at all.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate how much they need to qualify for a home loan. According tothe same article:

“Americans still overestimate the qualifications needed to get a mortgage,

resulting in qualified potential buyers not even considering homeownership.

Indeed, the Urban Institute report revealed that 16 percent of consumers

believed that the minimum down payment required by lenders is 20 percent

or more, and another 40 percent didn’t know at all.”

While many potential buyers still think they need to put at least 20% down for the home

of their dreams, they often don’t realize how many assistance programs are available with

as little as 3% down. With a little research, many renters may actually be able to enter

the housing market sooner than they ever imagined.

In addition to down payments, buyers are also often confused about the FICO® score

it takes to qualify for a mortgage, believing a ‘good’ credit score is 780 or higher.

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report,

which focuses on recently closed (approved) loans.

Whether buying your first home or moving up to your dream home, knowing your options

will make the mortgage process easier. Believe it or not – your dream home may already be

within your reach.

of their dreams, they often don’t realize how many assistance programs are available with

as little as 3% down. With a little research, many renters may actually be able to enter

the housing market sooner than they ever imagined.

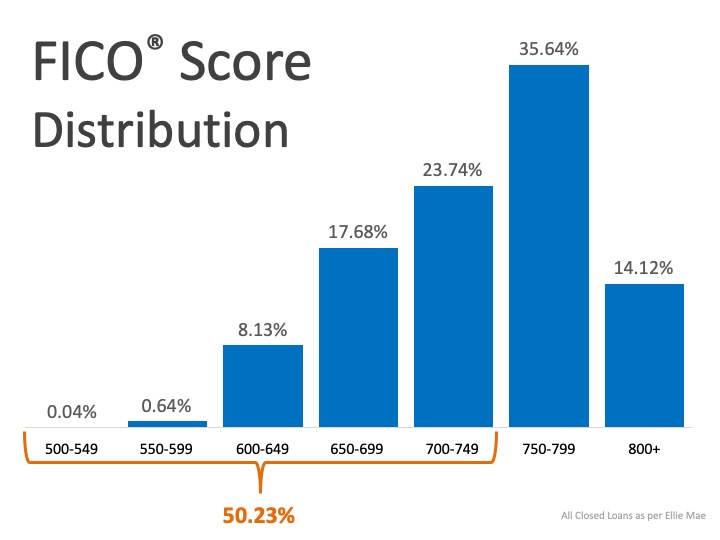

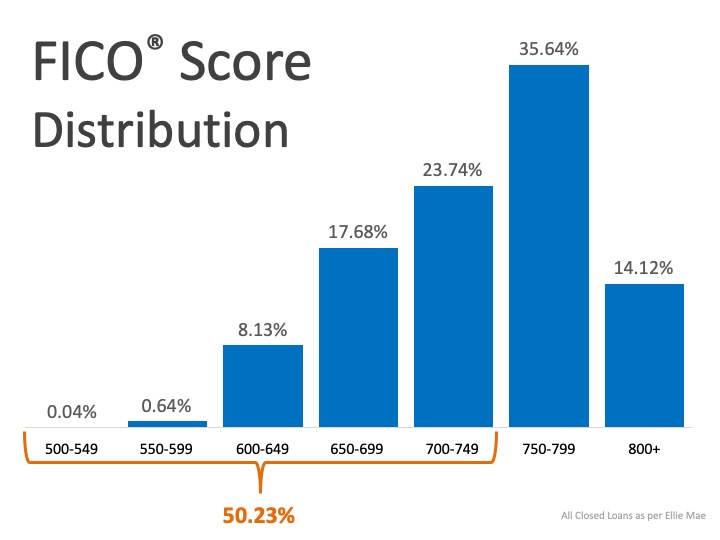

Myth #2: “I Need a 780 FICO® Score or Higher”

In addition to down payments, buyers are also often confused about the FICO® score

it takes to qualify for a mortgage, believing a ‘good’ credit score is 780 or higher.

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report,

which focuses on recently closed (approved) loans.

As indicated in the chart above, 50.23% of approved mortgages had a credit score of 500-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options

will make the mortgage process easier. Believe it or not – your dream home may already be

within your reach.

Contact me and land my team and I will find you a home of your choice, and make the transaction process smooth.

Asifa Zia- Realtor. MRP

Licensed in VA

Member of NAR, VAR, PWAR

Pearson Smith Realty LLC

43777 Central Station Dr #390, Ashburn, VA 20147

Offices in Fairfax, Woodbridge, Sterling, Leesburg VA

Cell:540-729-3470

Office:(571) 386-1075

Fax:571-386-1081

Website: www.buyandsellnorthvirginia.com

Find out what is your home worth Click Here

se habla espanol

Comments

Post a Comment